An algorithmic trading platform built for repeatable decision-making

FlyTradr is an algo trading platform designed to help traders turn ideas into evidence. Instead of jumping from a strategy idea directly to live execution, FlyTradr emphasizes a structured, inspectable loop: define rules, test them, stress assumptions, and only then scale.

Finance is a “trust” domain (YMYL). That means your tools should make it obvious why a result happened and what assumptions produced it. FlyTradr keeps the workflow transparent by storing strategies in a common DSL, and by surfacing realism settings (fees, slippage, latency) rather than hiding them.

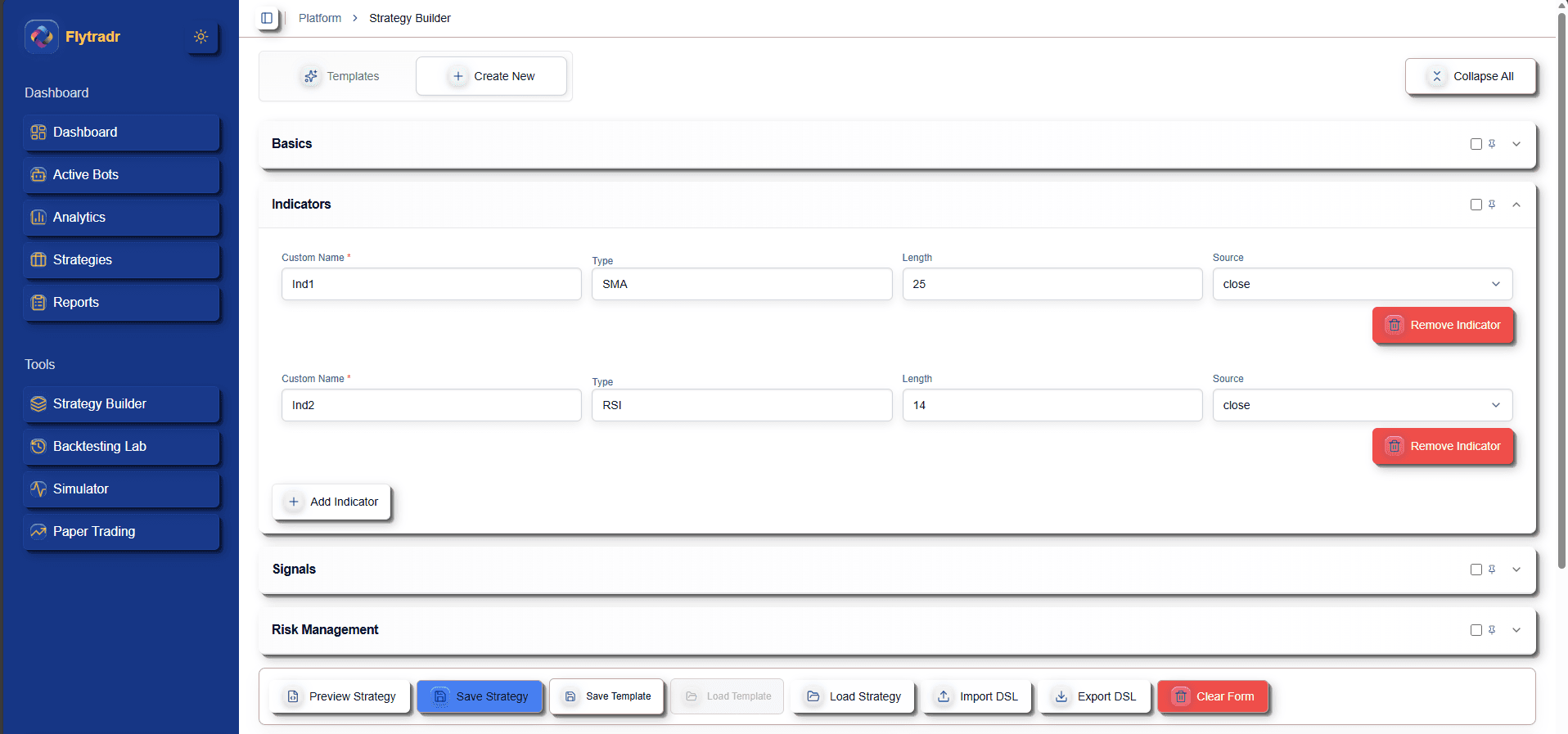

Visual strategy builder for creating rule-based trading strategies without code

The FlyTradr lifecycle

- Build: Create strategies visually in the Strategy Builder. Rules compile to a DSL so the same logic runs across tools.

- Validate: Run historical backtests, review trades, and compare risk metrics.

- Experience: Replay markets in the Trading Simulator to understand behavior bar-by-bar.

- Practice: Use Paper Trading to observe live-style execution with virtual capital.

What “finance-grade” testing covers

- Slippage & fees: model friction so backtests don’t overstate performance.

- Latency: approximate the delay between signal and fill.

- Data quality: understand gaps, bad prints, and survivorship bias.

- Position sizing: evaluate how capital allocation changes drawdowns.

Educational note: FlyTradr is tooling. It does not provide investment advice and does not guarantee outcomes.

Get started

Start with the free Explorer tier and run a few backtests. When you’re ready to practice execution, upgrade to unlock simulation and paper trading.