A trading simulator for learning how your strategy behaves

Most traders don’t fail because they never ran a backtest—they fail because they never understood how a strategy behaves when the market stops cooperating. A trading simulator is the bridge between “backtest results” and “execution reality.”

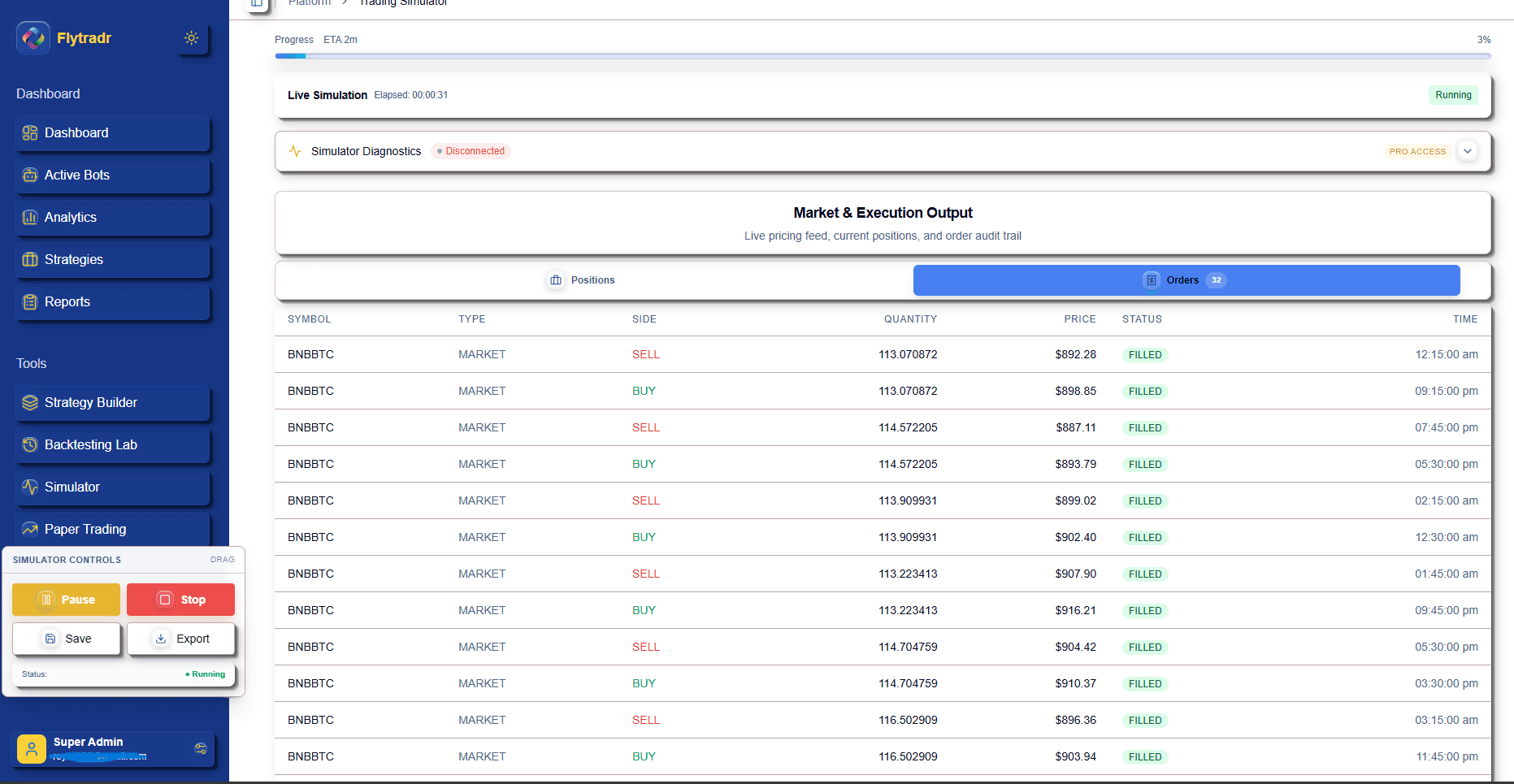

Interactive trading simulator with speed controls for replaying historical market data

What simulation helps you see

- Signal timing: whether entries appear early/late in a move and how often signals flip.

- Execution sensitivity: how slippage and latency assumptions change outcomes.

- Regime brittleness: which market regimes break your logic (chop vs trend vs spikes).

- Operational feel: does the strategy trade too frequently, over-leverage, or cluster risk?

A practical simulation routine

- Pick a period where your backtest drawdown was worst.

- Replay at slow speed and watch entry/exit logic.

- Increase realism (fees, slippage, latency) and observe changes.

- Record what assumptions are required for the strategy to work.

Suggested next step

Once simulation behavior looks stable, move to paper trading to validate live-style execution with virtual capital.

Educational note: simulation is a learning tool, not a guarantee of future performance.