Backtesting software that makes assumptions explicit

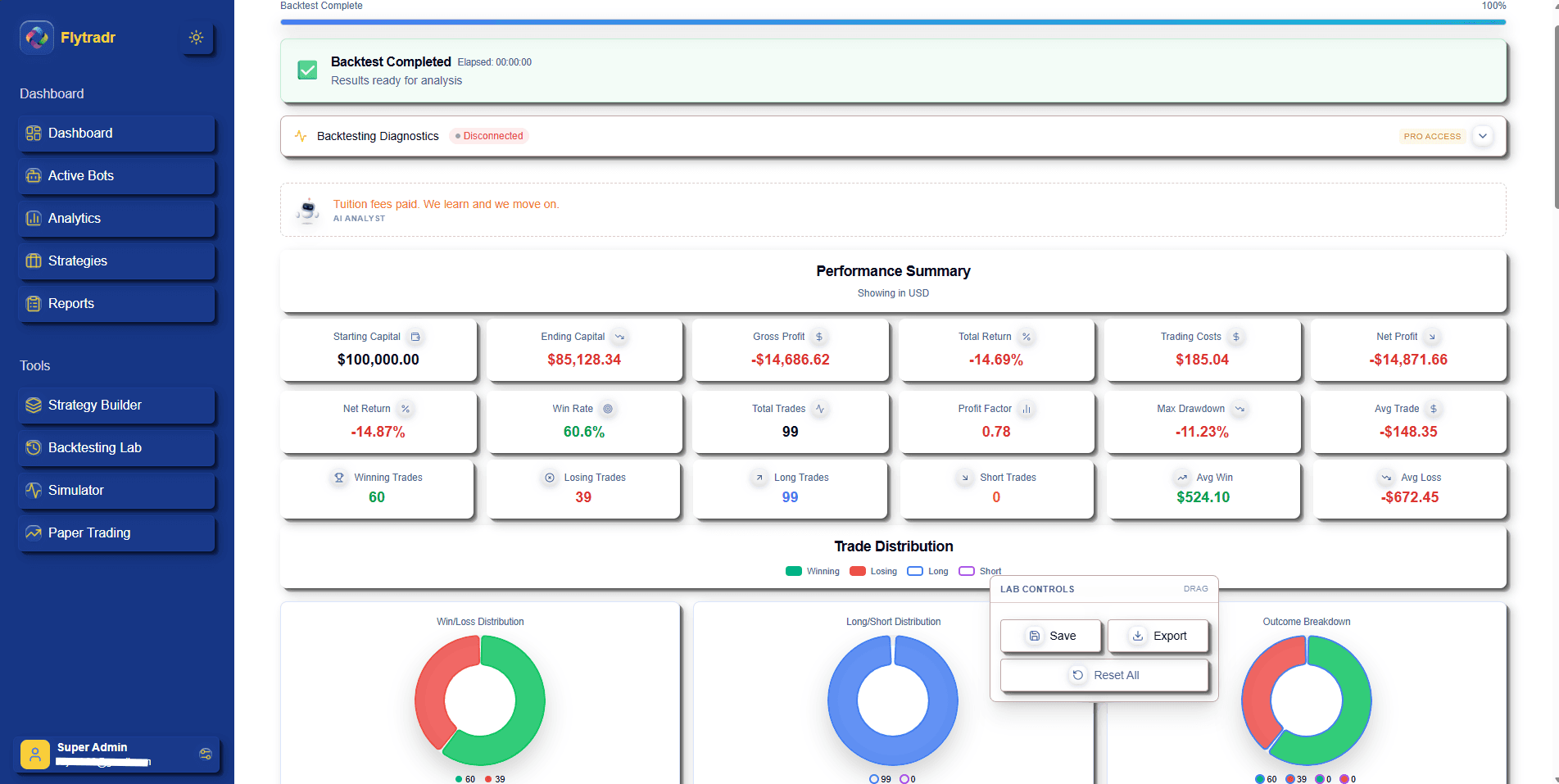

Good backtesting isn’t about producing the prettiest equity curve—it’s about building confidence that a strategy has repeatable logic and survivable risk. FlyTradr’s backtesting workflow focuses on transparency: what data was used, how trades were filled, what costs were applied, and how risk was managed.

Backtest results dashboard with realistic performance metrics and transparent slippage/fee accounting

What you validate in FlyTradr

- Strategy logic: entries, exits, indicators, filters, and risk rules (visual → DSL).

- Trade behavior: distribution of wins/losses, average holding time, sensitivity to fees.

- Risk profile: drawdown depth/duration, volatility of returns, and exposure.

- Stability: how results shift across time windows or different symbols/markets.

Common backtesting pitfalls

Many strategies fail in live markets because their backtests missed important failure modes. Here are the pitfalls FlyTradr encourages you to address:

- Survivorship bias: testing only on winners (e.g., today’s top stocks) inflates results.

- Overfitting: tuning parameters until the past looks perfect often reduces future robustness.

- Unrealistic fills: assuming fills at the best possible price is rarely true.

- Ignored execution costs: small fees and slippage compound quickly with frequent trading.

Next steps after a backtest

A solid backtest is the start, not the finish. Use the Simulator to replay tough market periods and understand bar-by-bar behavior, then paper trade to practice execution with virtual funds.

Educational note: backtests are estimates based on assumptions. FlyTradr does not provide investment advice.